Jean-Luc Ichard/iStock Editorial by way of Getty Photos

Funding Thesis

Vivendi SE (OTCPK:VIVHY) is about to report FY22 earnings, so I made a decision to take a look at France’s media large to see if there’s any alternative for a long-term funding. With progress estimates supplied by analysts, my progress estimates are a bit extra optimistic, but the corporate continues to be buying and selling at a premium and wouldn’t be an awesome funding proper now.

I’ll undergo some assumptions on the revenues that the corporate is producing and can attempt to provide you with some affordable progress numbers that I can see by analyzing earlier monetary reviews and any upcoming catalysts that may propel this progress additional.

Income Potential

In the newest years, the expansion has not been notably excessive, with the principle income generator, Canal+ rising at round 0%-1%, and it appears to have penetrated a lot of the market by now. Havas Group alternatively has been rising low double digits and might change into a significant contributor of revenues sooner or later. For my DCF valuation, I’ve separated Havas Group into its personal class as I wished to mannequin larger progress for this section than the remainder of the enterprise segments. Over 60% of complete revenues come from Canal+, so I pooled all the opposite revenues into Canal+ as they might not make as huge of an impression as Havas Group.

Havas Group is a significant participant within the promoting area globally and I consider it would proceed its progress at an analogous tempo sooner or later years as the corporate acquires extra so as to add to its portfolio of property. Within the first half of 2022, they acquired majority pursuits in 5 totally different companies, Tinkle, Inviqa, Search Laboratory, Frontier Australia, and Entrance Networks. These acquisitions will hold boosting its income progress sooner or later years. That is the rationale why I made a decision to go together with barely larger income progress estimates for the longer term than the expansion estimates I gave to the principle income section which incorporates the remainder of the enterprise segments with Canal+.

Different notable segments that both grew fairly significantly or managed to lose their market share over time are Gameloft, which grew round 48% q-o-q and low double digits within the first 9 months of 2022, and Editis which has been declining in current occasions in low single digits might be absolutely offered by Vivendi to finance the acquisition of Lagardère, a French media group. At the moment, the corporate owns over 55% of the Lagardère. Vivendi is at present working into anti-competition points with the European Fee as they consider if Vivendi acquires Lagarde, there might be much less competitors within the ebook publishing market in France and fewer variety.

Lagardère

Let’s have a look at Lagardère’s monetary scenario and the way it may also help Vivendi sooner or later. Lagardère lately introduced its FY22 outcomes, and the numbers have been wonderful. The corporate makes virtually €7B in income, 35% y-o-y enhance, and working margins have additionally improved. There are a lot of synergies for Vivendi if they’re to accumulate Lagardère and the administration appears very optimistic in regards to the future, particularly within the journey section which has recovered significantly.

There may very well be potential synergies between Vivendi’s present companies and Lagardère Journey Retail’s operations. For instance, Vivendi may use its experience in content material creation and distribution to boost the in-store expertise for vacationers, akin to by providing unique music, movies, or books. Lagardère Journey Retail section went from -€81m to +€136m EBIT because the pandemic has eased throughout Europe and all restrictions have been lifted. Lagardère lately accomplished its acquisition of Marché Worldwide which primarily operates inside journey and leisure areas, akin to airports, practice stations, and zoos. The acquisition additional cements its strategic ambition to change into the highest identify on this section. The sort of synergy is probably not the principle one for Vivendi, but it surely may be a great way to diversify its portfolio somewhat extra. Vivendi and Lagardère each stand to learn if the acquisition occurs within the subsequent 12 months and will propel Vivendi’s income progress additional.

Financials

With no-so-exciting income potential as of proper now, let’s take a look at how the corporate is being managed.

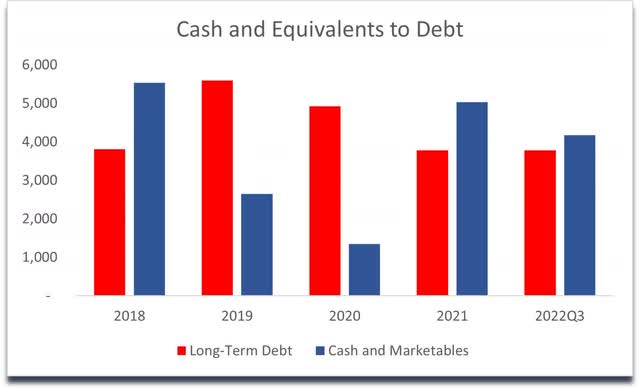

Money and equivalents have been enhancing towards the long-term debt of the corporate. Throughout 2019 and 2020 it appeared a bit worrying, nevertheless, Vivendi has been paying down debt whereas preserving its liquidity in verify. They don’t appear to have hassle overlaying their curiosity bills on debt because the ratio sits round 5.0 proper now.

Money to Debt (Personal Calculations)

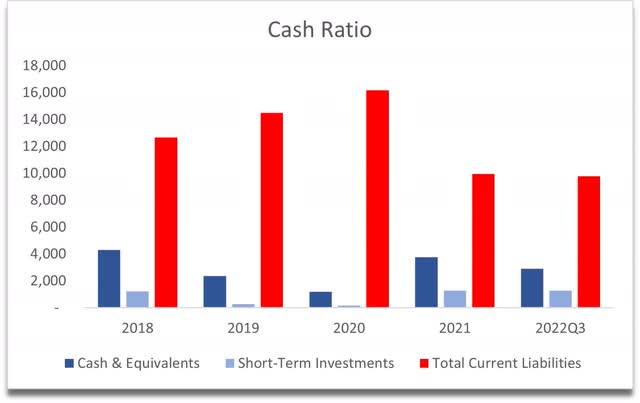

The money ratio will not be wanting good right here. I like firms that may cowl their short-term obligations with the accessible money available, nevertheless, it’s simply one other extra scrutinizing metric that traders like to make use of, and it doesn’t imply that the corporate is in any hazard of defaulting.

Money Ratio (Personal Calculations)

Return on invested capital can also be nothing excellent, fluctuating at mid-single digits.

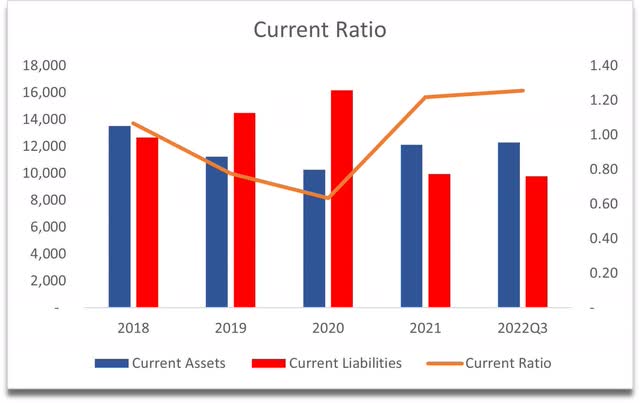

The present ratio is round 1, which can also be nothing to put in writing residence about, with more moderen years ticking up somewhat bit.

Present Ratio (Personal Calculations)

General, the books have left me with lots to be desired, and at this level, it might appear like the corporate is perhaps overvalued at a 20x ahead P/E ratio (in response to Looking for Alpha). With such progress prospects, I consider 20x ahead P/E is a bit excessive for what the corporate can produce. I’d additionally wish to see an enchancment within the above monetary metrics.

DCF Valuation

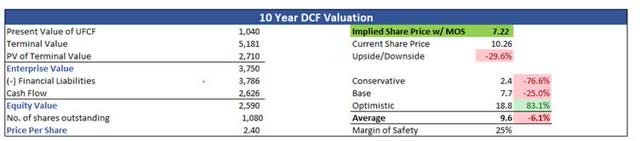

With the above-mentioned progress prospects, I’ve no motive to consider that the corporate may obtain excessive double-digit progress over the following 10 years. Analysts are saying that the corporate will develop at round 2%+ within the subsequent couple of years, nevertheless, I’m not that pessimistic, and I’ve modeled the expansion of Canal+ and different income excl. Havas Group at a mean of 6% per 12 months and income for Havas Group at a mean of 8% per 12 months within the base case state of affairs. The share progress in revenues is modeled in US phrases as are all of the figures in US$. Havas Group has grown in low-double digits in Euro, nevertheless, because the deterioration of the forex towards the US$, the expansion has been smaller.

I additionally modeled the worst-case state of affairs the place I took 2% off from the bottom case and an optimistic case the place I added 2% to the bottom case. Whole income within the base case common is 7%, 9% within the optimistic, and 5% within the worst-case state of affairs. Now since these numbers are simply my estimates and can range from different valuation analyses on the web site, and I like to offer myself a great margin of security of 25% to the ultimate implied share value to account for any mistaken estimations in my assumptions.

The implied share value with a 25% margin of security involves $7.22 per share, which means round a 30% draw back to the present value of the inventory.

DCF Valuation (Personal Calculations)

Dividend Mannequin

Because the firm has been paying some dividends over the previous couple of years, I made a decision to do a dividend valuation mannequin as properly. Excluding the particular dividend it gave to its shareholders in 2021, the dividend has dropped by round 60% bringing it to round 26 cents a share. If I assume that the corporate goes to have the ability to enhance its dividend by 5% in perpetuity, the value per share sits at $9.4, and if I apply a 25% MoS right here too, I get $7.03 per share.

Closing Remarks

Have I crushed down the inventory an excessive amount of in my fashions? Perhaps, nevertheless, there’s a number of uncertainty nonetheless on the planet. The inflation fee in Europe nonetheless sitting at 8.6%, which is simply barely down from final month. The Ukrainian disaster continues to be ongoing after a complete 12 months. These types of uncertainties make me a bit extra pessimistic, regardless of how properly the corporate seems to be in the long term, within the brief run, macroeconomic worries will have an effect on each inventory market on the market, and I’d relatively follow endurance than leap in and purchase on the mistaken time. Till we see the complete 12 months’s outcomes and the way the worldwide occasions unfold within the subsequent couple of months, I counsel a promote for now when you consider my progress prospects for the corporate are justified. I’ve it on my watchlist, and value alerts are a lot decrease than what the corporate at present buying and selling at.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.