Tom Werner

Run lean; keep away from pointless bills. – Richard Branson

In the event you’ve been following a few of the latest commentaries on the timeline of The Lead-Lag Report, you’d acknowledge that I have been highlighting how shares belonging to the expansion universe look to have misplaced their mojo.

Twitter

Inside that broad progress universe, you’ve gotten the retail sector, which, prima facie, might provide the impression that every one is properly there, notably as the newest retail gross sales enhance was the most important in two years. A few of it’s possible you’ll even be considering a leveraged guess on this sector by resorting to the Direxion Day by day Retail Bull 3x Shares ETF (NYSEARCA:RETL), which makes an attempt to offer 3x the “every day” return of the S&P Retail Choose Business Index. Earlier than you bounce the gun with this product, listed below are some issues it’s best to take into account.

Circumstances Are Not Preferrred

On the face of it, the latest progress in retail gross sales was spectacular, however it’s questionable if this can final going ahead, because the bounce was seemingly pushed by seasonality elements.

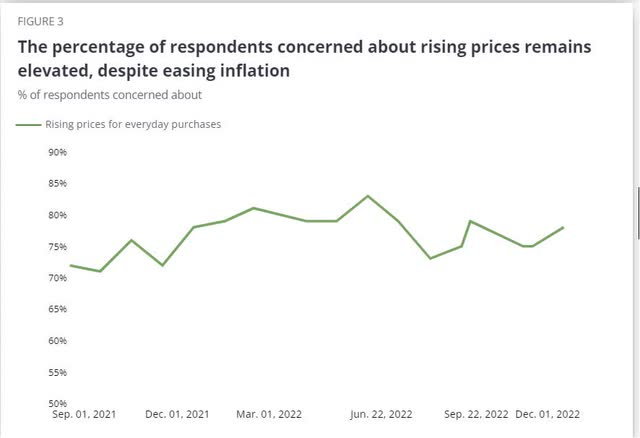

Structurally, the U.S. shopper is going through some difficult circumstances, which might recommend that one must be cautious on this sector. Firstly, it appears like inflation is much more entrenched than one initially thought, and even when you suppose we’re near a peak, a latest survey by Deloitte highlighted that customers stay involved about excessive costs and the impact on buying energy.

Deloitte

You would not essentially blame the common U.S. shopper when probably the most essential parts of his/her internet worth-housing seems to be in a freefall. I touched upon what’s driving the weak spot with a few friends on a Lead-Lag Stay episode.

Twitter

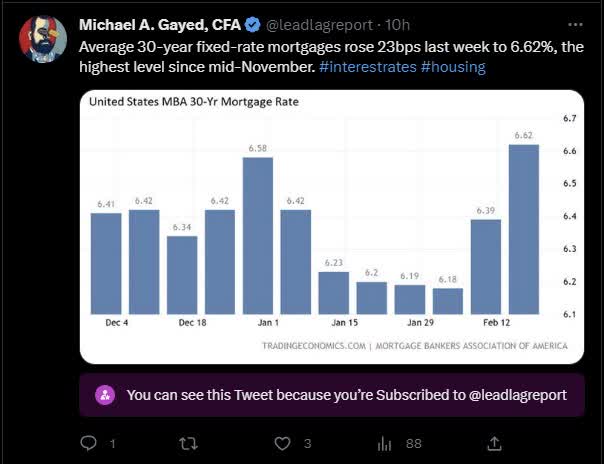

Then you’ve gotten the Fed desperately attempting to place a lid on inflation, and final week’s report solely reiterate its long-standing hawkish positioning for the foreseeable future. The bottom case now’s for 75bps of extra price hikes, with the potential for this to even hit 100bps. Unsurprisingly, mortgage financing prices at the moment are again to hitting some uncomfortable ranges.

Twitter

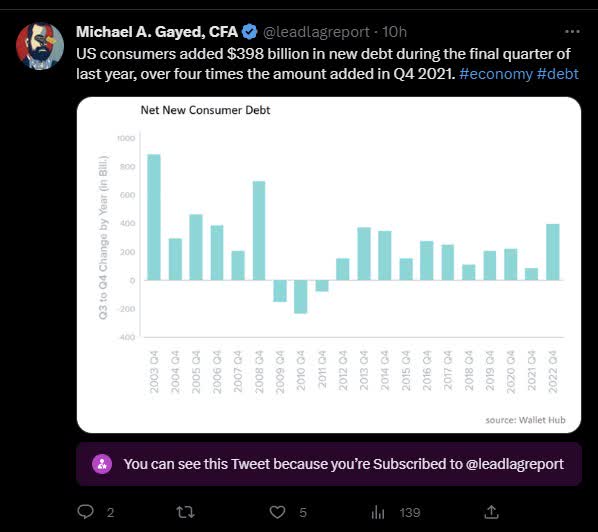

One does surprise concerning the debt servicing talents of U.S. customers within the face of upper charges, notably as they proceed to tackle much more debt. As famous in The Lead-Lag Report, in the direction of the tip of final yr, new shopper debt rose by 4x on a YoY foundation.

Twitter

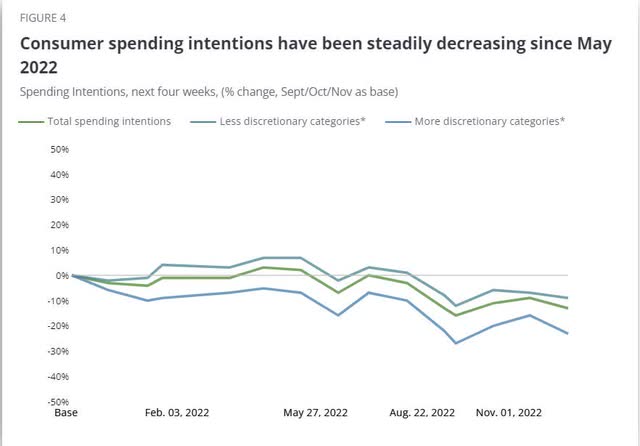

Along with weak shopper well being, one additionally ought to contemplate that a lot of the latest retail gross sales momentum was seemingly pushed by a powerful promotional setting, notably in classes comparable to attire, which RETL’s monitoring index is closely uncovered to. These retailers do not have a lot of a alternative as shopper spending intentions, notably with discretionary classes, proceed to plummet, so the one technique to get a base-level quantity is to ramp up the promotion lever. Sadly, this can replicate poorly on the gross margins of those retail entities.

Deloitte

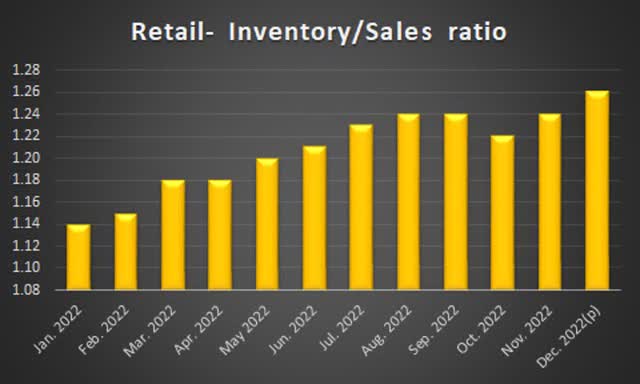

Retailers comparable to Goal (TGT) have been vocal in taking part in down any undue enthusiasm within the retail sector, stating that larger markdowns have been very instrumental in driving down discretionary inventories in the direction of the tip of final yr. In the event you recollect, a lot of the narrative in H2-22 was centered round how the stock place of those retailers was weighing closely on money era and the steadiness sheet. You’ll suppose this threat would have abated by now, however wanting on the newest stock/gross sales ratio throughout the retail sector, it seems that markdown pressures (and the corollary impact on gross margins) will persist in 2023 because the I/S ratio completed the yr at its highest level!

Census

Even when extra promotions are pushed by means of, there is no assure that there shall be any takers, notably when you think about the bumbling state of shopper funds within the face of upper inflation, and better value of capital. The likes of Greenback Tree (DLTR) and Walmart (WMT) have already implied that buying habits have now shifted from discretionary gadgets to meals and consumables.

Conclusion

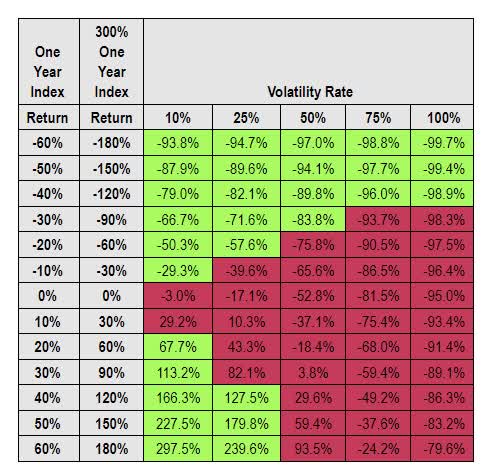

Whereas circumstances within the retail phase do not look too brilliant, the prospects for RETL look much more daunting when you think about the leveraged nature of this product and its susceptibility to volatility. On account of its every day reset nature, it is a product higher suited to fast directional swings, quite than one thing you need to personal for a chronic interval. I say this as a result of, even throughout flattish actions, this product might find yourself burning a gap in your pocket if volatility circumstances stay elevated.

Direxion

The desk above highlights that even when RETL’s monitoring index delivers no returns, you may nonetheless find yourself shedding 3% when annualized volatility is 10%. With Direxion Day by day Retail Bull 3x Shares ETF that’s hardly the bottom case, because the annualized volatility of the ETF XRT has been round 37%; assuming the same cadence going ahead, and you may be taking a look at drawdowns of over 30% if the index stays flat over a yr.

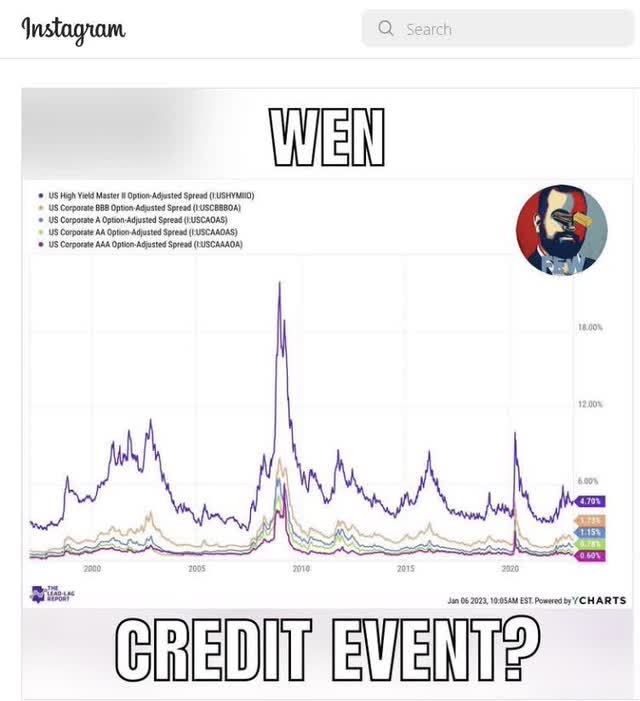

Instagram

All in all, as famous in a publish on the Lead-Lag Report’s Instagram web page, a volatility spike will not be too distant, and it’s possible you’ll first see this come by means of through credit score spreads earlier than it spills over to the fairness markets. Throughout instances like this, you do not need to be overly uncovered to a product like Direxion Day by day Retail Bull 3x Shares ETF.