RobsonPL

Expensive readers/subscribers,

Credit score Agricole S.A (OTCPK:CRARY) has delivered engaging efficiency since late 2022, although let’s be trustworthy most European firms have really managed engaging efficiency since that point. I’ve spent some capital investing on this financial institution – I simply have not been writing a lot about it, as a result of my funding has been so small, and different investments have been extra engaging to jot down about and to spend money on, to be trustworthy.

Nonetheless, I figured now was a wonderful time to begin pushing Credit score Agricole a bit – as a result of the thesis is curiously advanced.

Let me present you what I imply.

Credit score Agricole – The Financial institution and its thesis

The financial institution, which by the way in which is thought in its native France as La Banque Verte, or the “inexperienced” financial institution, is headquartered in Montrouge in France, employs over 140,000 individuals, and is among the main banks within the nation. The “inexperienced financial institution” title comes not from its ESG focus, however the truth that it has very sturdy ties to farming in France.

What will be mentioned, as a result of Credit score Agricole is definitely the world’s largest in one thing, is that it’s the world’s largest cooperative monetary establishment. It is also France’s second-largest financial institution after Paribas (OTCQX:BNPQF). It is also the third-largest in Europe, and is within the top-twenty largest banks on the planet, producing revenues effectively over €20B per 12 months.

This financial institution began out very small, selling lending to small household farms which on the time was promoted by the French authorities and paved the way in which for the corporate’s native financial institution, arrange by native elites and aristocrats. Farmers had been the lenders, not the homeowners, and the preliminary enterprise was primarily short-term loans reminiscent of advances on crops which enabled farmers to reside extra securely. This was then expanded to different sorts of monetary mortgage merchandise, which enabled farmers to purchase tools in addition to different issues wanted to develop.

The corporate turned nationwide in 1900-1945, survived the warfare and the reconstruction which inspired the huge mechanization of farming, and have become extra of a common financial institution in 1966. The financial institution was allowed to supply households related merchandise on the time, and the primary subsidiaries had been created within the late Sixties. Credit score Agricole went worldwide in 1979, when it opened a Chicago Workplace, and was shortly ranked among the many world’s main. On the time, it turned topic to the banking code – beforehand it had been topic to the agricultural code as a cooperative, and diversification went onward, with internationalization and so forth.

Nonetheless, it retains its roots as a cooperative to today.

It hasn’t been hurt-free. Credit score Agricole noticed a major impression through the disaster of 2008. When the interbank lending market seized up, it compelled Credit score Agricole to liquidate its holding in Suez at a worth of €1.3B, considerably beneath the place the financial institution valued or wished to carry it. The financial institution was additionally compelled to prepare a virtually €6B rights subject, along with a disposal program of one other €5B. It was a chaotic time for banks and all European establishments making an attempt to fulfill Basel necessities.

On the finish of 2008, the federal government determined to mortgage France’s six largest banks €21 billion in two tranches, at an rate of interest of 8%, to allow them to proceed to play their position within the economic system. Nonetheless, Credit score Agricole didn’t partake within the secondary tranche – it didn’t want it, and paid it again lower than a 12 months later (the primary tranche). The corporate was really one of many higher banks to go away the disaster, and the share worth bounced again over 40% in 2009 alone.

As such, it was one of many first-recovering banks in Europe – even earlier than most Swedish ones.

Credit score Agricole immediately, will not be a foul financial institution in any means.

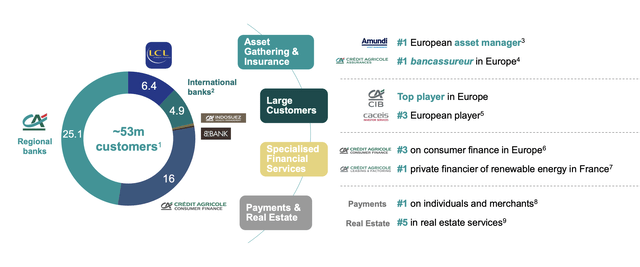

Credit score Agricole IR (Credit score Agricole IR)

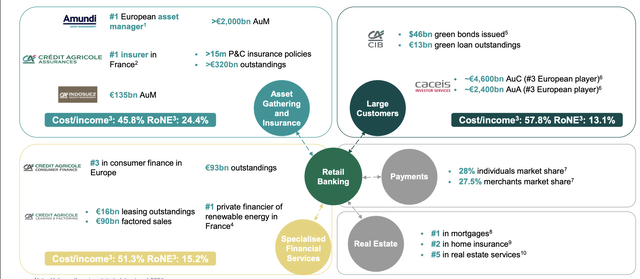

As you may see, 53M clients with segments unfold in AM, Giant clients, specialised, and funds/RE makes this firm a significant participant basically in all of Europe. Amundi, which by the way in which I’ve written about earlier than, is the #1 European asset supervisor with over €2T in AUM, complemented by the most important insurer in all of France. This financial institution is a well-oiled machine that covers the complete spectrum and it’s all centered round its retail banking operations.

Credit score Agricole IR (Credit score Agricole IR)

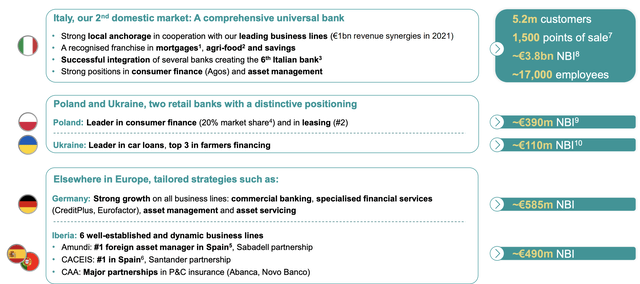

Need some spectacular stats? 1 out of three people, 8 out of 10 farmers, and 1 out of two companies have a buyer relationship with Credit score Agricole. It is the #tenth largest financial institution on earth, the most important retail financial institution in the complete EU, and never simply in France with its publicity. Check out a few of the non-France publicity, in what we will name the corporate’s “progress markets”.

Credit score Agricole IR (Credit score Agricole IR)

The corporate has a really confirmed enterprise mannequin and was one of many main suppliers of SGLs in France throughout COVID-19 – almost 1 / 4 of the whole quantity.

What’s extra, the financial institution’s latest outcomes for 2021 and early 2022 just about all meet their targets effectively forward of the deliberate schedule that the financial institution initially labored with. The corporate has normalized its payout to 50% of earnings, a near-12% phased-in CET1, important price discount, web revenue above €5B with a CAGR of above 4%, at 7% for 2021, and an underlying ROTE above 11% each in 2021 and 2022.

The financial institution has liquidity at €140B and above, and a mortgage protection ratio of above 85% – top-of-the-line within the enterprise. It is also making an attempt to market itself to HNWI, professionals, and entrepreneurs, which appears to be working, although I am personally hoping the financial institution doesn’t overly deal with this. One of many risks, when banks diversify an excessive amount of, is their progress or enlargement into non-core segments which grow to be nonprofitable, however the financial institution retains shovelling capital in to attempt to make it work. I would fairly see any firm deal with what it will probably do, fairly than making an attempt to turn out to be a grasp of none.

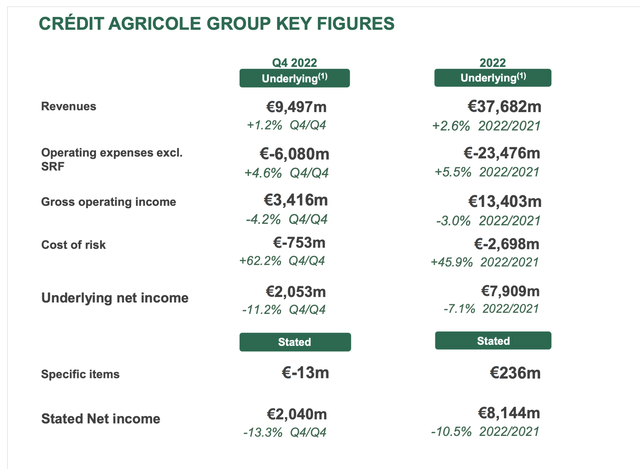

Now we have 4Q22 outcomes. These outcomes had been wonderful. How had been they wonderful?

Document excessive 4Q revenue, up virtually 7% YoY, virtually a 4.5% improve in revenues, which got here from each single enterprise line on the market. And once more, the financial institution as soon as once more beat its total targets.

Credit score Agricole IR (Credit score Agricole IR)

And, as you may see, a very good dividend for the 12 months, which brings the corporate’s yield effectively into aggressive ranges on a European and worldwide foundation. Check out the high-level outcomes, and you will see why I am optimistic about most issues for the corporate right here.

Credit score agricole IR (Credit score agricole IR)

Credit score Agricole can also be attention-grabbing as a result of it plans to, probably because of its Polish publicity, be one of many first main banks to actually enter Ukraine as soon as the battle is resolved. There’s prone to be a retail banking enlargement within the geography as soon as issues die down total by way of conflicts.

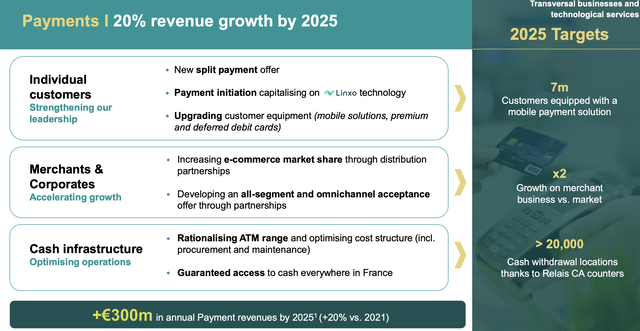

And Credit score Agricole has very bold targets going ahead, with a double-digit 20% income progress as soon as we hit 2025E.

Credit score Agricole IR (Credit score Agricole IR)

Credit score Agricole is not doing something distinctive per se, what offers the corporate an edge is its already-market-leading place and fundamentals, that are past stable right here. The corporate is introducing a fully-digitized buyer journey, with real-time KYC, however this isn’t distinctive in banking immediately any longer. And talking for myself and many individuals I do know, particularly within the HNWI/VHNWI-segment, many of the shoppers there demand and need a private contact of their banking and total service sectors – so banks like this one ought to preserve that in thoughts.

Dangers to this financial institution are few – at the very least on the upper degree. There are some valuation concerns- extra on these in a bit, however other than valuation considerations, there actually is not a lot to complain about right here.

Credit score Agricole is uncovered to some high-level danger, however this isn’t distinctive to this financial institution. I am speaking about issues like the price of danger, NPL’s and different delinquencies, and whether or not the financial institution’s degree of capitalization is enough for what’s coming. As a result of Credit score Agricole has a mess of exposures each in insurance coverage and different fields, this comes with its personal subsets of segment-specific dangers, however once more – there is not something particular that is non-performing to any worrying degree right here.

So as a substitute, let’s deal with the place the crux of the matter is.

Credit score Agricole’s valuation is not that engaging

So, first off. Credit score Agricole is adopted by 20 analysts, which give the corporate a spread beginning at €5.55 and a excessive of €17.3 – an excessive vary right here, with a mean about €12/share. The corporate presently trades at €11.56. This places the corporate at a small upside of round 4%.

That is the corporate’s present forecast.

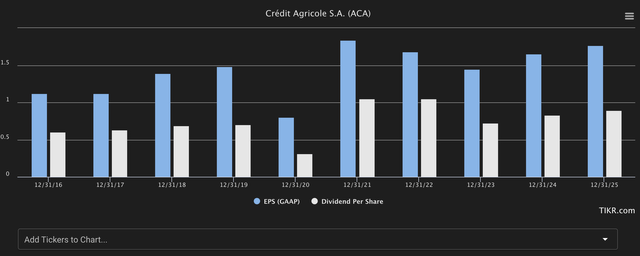

TIKR.com Agricole forecasts (TIKR.com Agricole forecasts)

As you may see, the corporate has no drawback shortly adjusting its dividend to account for momentary shortfalls. That is what Agricole does, when essential. We’re anticipating a small downturn on this fiscal, however solely a momentary one – nonetheless, the mixture of a really excessive valuation coupled with this downturn has solely 4 of the analysts calling this one a “BUY” right here. Agricole traded at beneath €9/share lower than a 12 months in the past, which might have been a wonderful time to “BUY”, however sadly, this isn’t the case any longer.

Agricole trades at a peer group that features a number of banks and monetary firms, and it’s neither significantly overvalued in comparison with friends just like the Nationwide financial institution of Canada, Canadian Imperial (CM), Truist (TFC), and others. Additionally it is not, nonetheless, significantly low cost. There’s not a lot to love right here from a peer perspective by way of undervaluation.

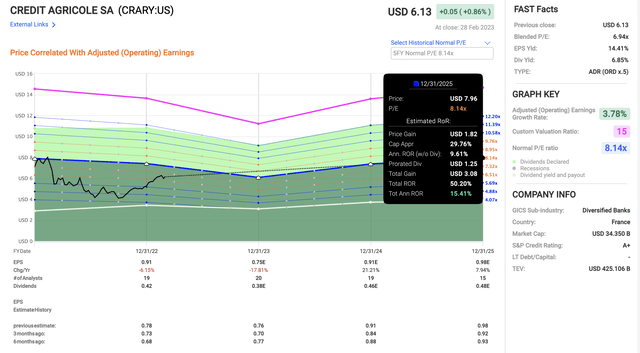

The identical is true from a forecast upside perspective. Due to an expectation of a double-digit decline, this caps the potential upside we’re capable of see right here, and a forecast to the typical of 8-10x offers us a unfavourable RoR for this 12 months, or near it. Nonetheless, because of EPS progress expectations to 2025 in accordance with the corporate’s forecasts, that is what we’re seeing on an 8.1x P/E.

F.A.S.T graphs Credit score Agricole (F.A.S.T graphs)

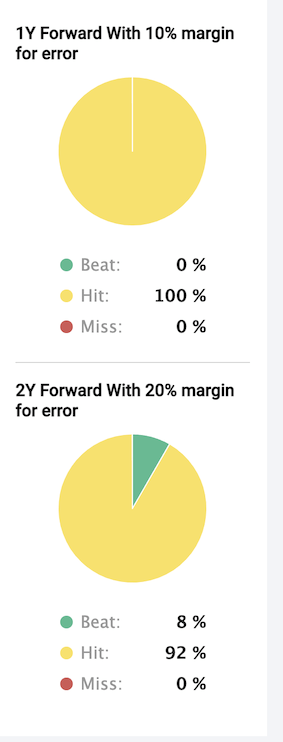

So, that is extra first rate. Nonetheless, I’ve an issue with this. The corporate has been on a climb for the previous few quarters, however I imagine that is untimely, and we’ll see a decline within the firm’s valuation on account of the extra unfavourable quarterly earnings we’ll probably see in 2023. I imagine this to be correct, as a result of analyst accuracy for this firm is nothing in need of very good. FactSet analysts haven’t missed estimates for this enterprise.

Credit score Agricole analyst accuracy (F.A.S.T graphs)

So, the rationale that I imagine this firm is not a “BUY” right here is just due to the valuation, which I see as being too costly partially from historicals, partially from friends, and partially from the near-term forecasts. I imagine that we will purchase Credit score Agricole cheaper than we’re presently seeing.

For that motive, that is my thesis on the financial institution at this specific time – and my first official score for Credit score Agricole.

Thesis

- Credit score Agricole is a superb financial institution, with stable fundamentals and good long-term progress prospects. It is one in all Europe’s main banks, and it is also the most important cooperative monetary establishment on earth. It has an ideal yield and an A score by way of credit score. On the proper valuation, this firm turns into a particular “BUY”.

- Nonetheless, at this specific valuation, the corporate has already realized a lot of the place I’d see its progress potential. For that motive, I’d be very cautious right here, even when the longer-term potential may be very first rate.

- I imagine we’ll be capable of purchase it cheaper, which suggests I’ve a “HOLD” score right here, with an €11/share PT.

Keep in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

- If the corporate goes effectively past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1.

- If the corporate would not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is basically protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low cost.

- This firm has a sensible upside that’s excessive sufficient, based mostly on earnings progress or a number of enlargement/reversion.

I say this firm presently fulfills 3 out of 5 standards, which suggests I am at a “HOLD” right here.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.