sefa ozel

In July 2021, I launched an article arguing that shares, particularly, progress shares are unreasonably overvalued and are as a result of crash on account of excessive inflation and a consequent increase in rates of interest. Quick ahead, almost all of the talked about names are down 50% or extra. Nevertheless, I’m not revisiting outdated predictions and praising myself, as predicting a crash in a inventory buying and selling at over 40 instances Worth to Gross sales will not be an enormous accomplishment.

As a substitute, I used to be largely flawed, since I anticipated the broader market, together with giant caps that signify the spine of the financial system to crash as nicely. Nevertheless, the market has solely contracted roughly 5% since that article, while many firms reached new all-time highs on account of reporting document earnings. That stated, whereas the market crashed some 25% since its all-time highs in October, it has rebounded steadily since, because of this of better-than-feared earnings, and cooling inflation in some sectors. Nevertheless, as inflation continues to remain elevated, the Federal Reserve can have little room to chop charges within the foreseeable future. As inflation depletes shoppers buying energy, giant firms that fared comparatively nicely will see earnings fall sharply in coming quarters. It’s, due to this fact, not unreasonable to anticipate a 30% crash within the S&P 500 and a 20% crash in world equities comparable to MSCI World Index.

Valuations Stay Excessive

The swift opening of the worldwide financial system, following the Covid pandemic, coupled with excessive shopper financial savings and world shortages, has led to the best inflation seen in over 40 years. Consequently, the federal reserve raised rates of interest to the best since October 2007, following a decade of low-interest charges. Whereas the rise in inflation and rates of interest actually damage the valuations of high-growth firms and extremely in-debt corporations, it didn’t meaningfully have an effect on pro-cyclical shares.

In actual fact, fairly the other has been the case to date. Right here, vitality firms have recorded document earnings as a result of surge in oil costs. Apart from vitality firms, sectors comparable to commodities, agricultural, monetary, and shopper staples have been seen benefitting from inflation and rising their earnings in keeping with, and even above inflation charges. Main giant caps, comparable to Exxon Mobil (XOM), Reserving Holdings (NASDAQ:BKNG), Caterpillar (NYSE:CAT) and Morgan Stanley (NYSE:MS) are up double-digit percentages year-over-year, regardless of the broader market sell-off. These and lots of different firms have held up the general index and prevented an total recession, as a result of distribution of earnings to different industries. That stated, even firms within the expertise sector fared comparatively nicely. As an illustration, tech big Microsoft (NASDAQ:MSFT) continued to develop revenues in its final quarter, whereas Apple (NASDAQ:AAPL) solely noticed a small lower in revenues after document income progress throughout the pandemic.

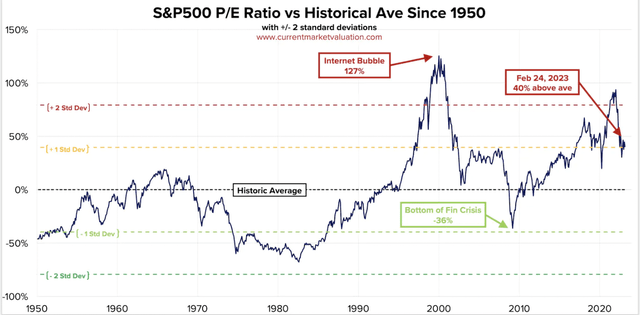

Historic Worth to Earnings Ratio – S&P 500 (Present Market Valuation)

However, firms that benefited from the excessive inflationary surroundings additionally noticed their valuations broaden sooner than their precise earnings progress. Take Caterpillar for instance, which now trades at 23 instances Worth to Free Money Move, in comparison with its historic common of round 13 instances. The identical applies to Vitality firms that at the moment commerce on the similar or increased earnings multiples than earlier than inflation took off.

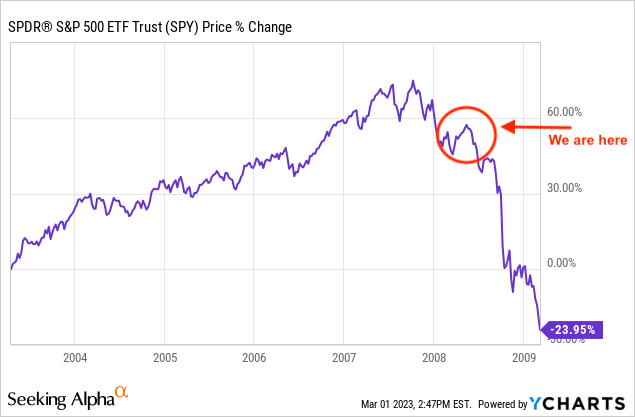

Nevertheless, the primary thesis of the present market rebound relies on the idea that vitality costs will drop, and in flip, cool inflation, permitting the Fed to steadily decrease charges once more. Nevertheless, in that case, the above-mentioned ‘winners’ ought to see earnings fall alongside their valuations. If vitality and commodity costs don’t cool and inflation stays excessive, the Fed might want to maintain rates of interest up, and even improve them, which in flip will additional drain liquidity from the markets and decrease valuations.

Within the second choice, even pro-cyclical shares will see earnings fall, just like 2008, as demand will dry up accordingly. Private financial savings have already dropped considerably, as inflation has outpaced actual wages of the decrease and center courses, which make up the biggest parts of the GDP. Nevertheless, as costs for primary items have been surging currently, the everyday center class is being positioned at elevated danger of dropping its wealth and buying energy. As financial savings dry up, tens of millions on the border between Higher and Decrease earnings ranges will lower consumption, merely as a result of affordability.

This may have an effect on luxurious items, comparable to journey, however might additionally have an effect on sure worth segments of requirements. But, regardless of an nearly imminent drop in these items and providers, firms inside these sectors are priced at document valuations.

Compiled by Writer

Now, the case I’m making an attempt to make is that the present valuation of each cyclical and non-cyclical shares simply doesn’t replicate and worth in present dangers. That stated, the common P/E ratio of all firms inside the S&P 500 index at the moment stands at roughly 28.3, which is 40% increased than the historic common of 19.6. The present earnings ratio interprets to a yield of three.5%. Nevertheless, the present rate of interest stands at 4.57%, which doesn’t appear to be rather a lot, but it interprets to a 30% distinction. It must be famous that the latter additionally comes with a danger premium of zero, while shares face lowering earnings in a looming recession.

A part of that discrepancy is probably going partially tied to expectations of soon-approaching fee cuts, wherein case the above-mentioned distinction ranges out. Nevertheless, drastic rate of interest cuts are to not be anticipated except inflation drastically decreases. As proven by the newest knowledge from each the Eurozone and the U.S. exhibits, inflation stays resilient and locations stress on central banks to even additional improve charges.

If upcoming knowledge exhibits the financial system moderating and inflation slowing, Waller stated he would “endorse” the goal federal funds fee rising to roughly the identical spot policymakers projected as of December, when 13 of 19 officers noticed charges coming to relaxation someplace from 5.1% to five.4%. – Reuters

In January, inflation within the U.S. got here in at 6.4%, and whereas that is decrease than the 6.5% recorded in December, it’s nonetheless removed from the FED’s goal of two%. Early in February, knowledge confirmed that the patron worth index in January cooled lower than economists had anticipated. Furthermore, the usjobs report firstly of February confirmed that half 1,000,000 employees had been employed in January, nearly 3 times what economists had predicted. In the meantime, the inflation scenario in Europe appears to be like much more regarding, with inflation in France and Spain unexpectedly accelerating and growing to 9.3% from 9.2% in January in the remainder of the EU zone.

Traders will now be specializing in the subsequent job report which is because of be reported on March 10, forward of the FOMC February assembly on March 21-22, the place the Fed is predicted to lift charges by one other 0.25 foundation factors.

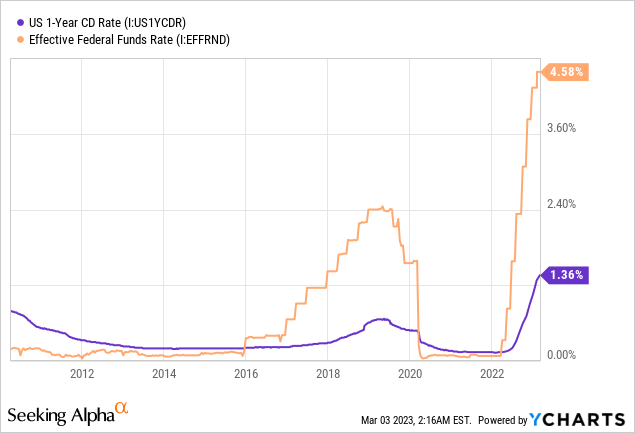

Nevertheless, as talked about, shares are at the moment priced for swift financial easing. If, nevertheless, the other is the case, shares will broadly drop 20-30% inside weeks, whereas the upside is already priced in. As of proper now, traders are staying invested in equities to counteract the deteriorating worth of money, regardless of carrying extra dangers. This is smart, as present financial savings accounts supply a mere 1-2% in annual curiosity, far lower than present inflation.

Nevertheless, as soon as banks improve their curiosity on financial savings to say 4-5% yearly and authorities bonds leap to 7%, the market will face unprecedented outflows, resulting in huge valuation cuts.

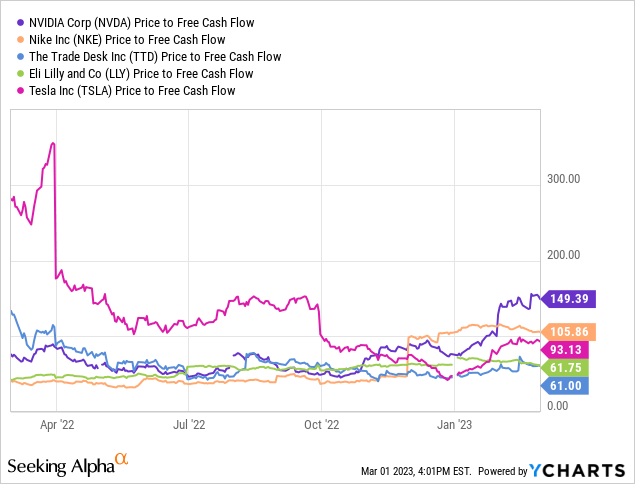

Y-Charts (compiled by creator)

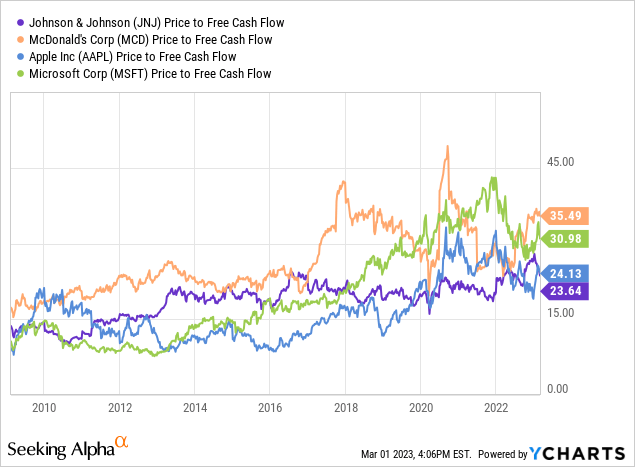

The S&P 500 and arguably even the MSCI World Index are each comparatively concentrated in a number of mega-cap shares that noticed their valuations broaden drastically during the last decade. For instance, Apple expanded its valuation from its low in 2013 at 7 instances Worth to Free Money stream greater than threefold to over 24 instances as of proper now. That is regardless of unsure financial situations and far increased rates of interest. If a broad recession strikes, an organization within the luxurious section like Apple will seemingly be affected first and most severely; but, by some means, its valuation suggests otherwise.

The identical applies to Microsoft, which has seen its valuation develop from simply 8 instances its annual working free money stream to over 30 instances as of at present. The query is that if traders will proceed to take a position or be invested in an organization providing a 3.5% yield once they can get a 6% yield on risk-free bonds. Nevertheless, it isn’t simply the index heavyweights which have inflated massively over the previous decade. Pharmaceutical big Johnson & Johnson (NYSE:JNJ) greater than doubled its trailing 12-month P/E ratio since 2011. The identical applies to McDonald’s (NYSE:MCD), Nike (NYSE:NKE), and lots of extra. Even when a recession doesn’t happen and earnings do not fall, a pure valuation reset might drag the index down 30% or extra.

Paradoxical Rebound in Progress Shares

Nevertheless, not solely defensive and extremely worthwhile firms have been rebounding since October. Excessive-growth shares, significantly expertise shares have been surging by as much as 100% after being crushed all through most of 2022. That is stunning, contemplating that many Tech shares have confronted slowing progress amid a reopening of the financial system and decrease capital accessibility to fund progress. Consequently, the business confronted a tsunami of layoffs which proceed to this date.

In notes to laid-off workers and traders, the businesses blamed an financial downturn and diminished buyer spending for the choice. Nevertheless, this did not appear to scare off tech traders an excessive amount of, as the longer term for revolutionary applied sciences like AI appears brilliant. Within the highlight of this revolution stands the substitute intelligence chatbot ChatGPT, which is in a position to reply to text-based queries and generate automated language responses.

The ChatGPT craze unfold to a bigger crowd of forgotten tech stars like C3.ai (NASDAQ:AI), Shopify (NYSE:SHOP), monday.com (NASDAQ:MNDY), and others. Whereas a few of these names proceed to develop revenues, their valuations are merely unjustified, regardless of already contracting from all-time highs in 2021. Nvidia (NASDAQ:NVDA) for instance, reported a 20% drop in revenues and a 58% drop in working earnings in its final earnings name, but the inventory is up over 100% since its year-lows and is slowly approaching all-time highs as soon as once more. It appeared as soon as progress slows, that Nvidia could be valued primarily based on its earnings, but at over 100 instances working free money stream this doesn’t appear to be the case.

In the meantime, ‘conventional’ chip producers comparable to Intel (NASDAQ:INTC) are valued at one-tenth of their valuations, as they apparently acquired nothing to do with AI. Thus, whereas I do consider that many of those firms have a confirmed and modern enterprise mannequin, the valuations might simply shed 60-80% and drag down main indexes such because the NASDAQ 100 (QQQ).

The place to Disguise Out

Because the financial system faces a possible recession, overvalued equities face important draw back. So traders might search for various funding alternatives to counteract inflation. In any case, plain money will lose its worth shortly if inflation continues on the similar fee. It must be talked about that similar to throughout each market part, there are shares that show to be a protected haven. As an illustration, the healthcare and pharmaceutical sector proves to be comparatively resilient to financial downturns and geopolitical conflicts. Right here, main prescribed drugs comparable to Pfizer (NYSE:PFE) commerce at beneath 10 instances Worth to Earnings and show a sturdy steadiness sheet. As all the time, traders have to place their portfolios primarily based on private danger profiles and given timeframes. If the timeframe is brief to medium-term, it might be finest to attend in an effort to obtain a extra favorable entry level.