Rost-9D

Common Stainless & Alloy Merchandise (NASDAQ:USAP) is an American metal alloy producer. The corporate has 4 services within the Northeast.

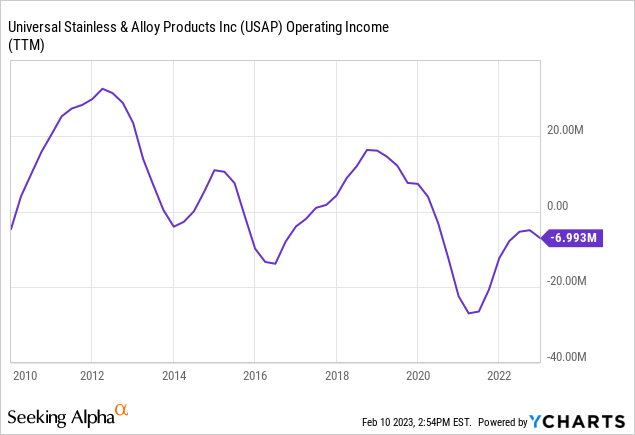

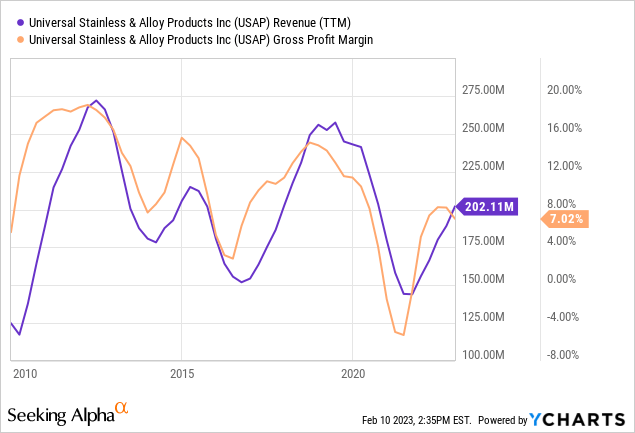

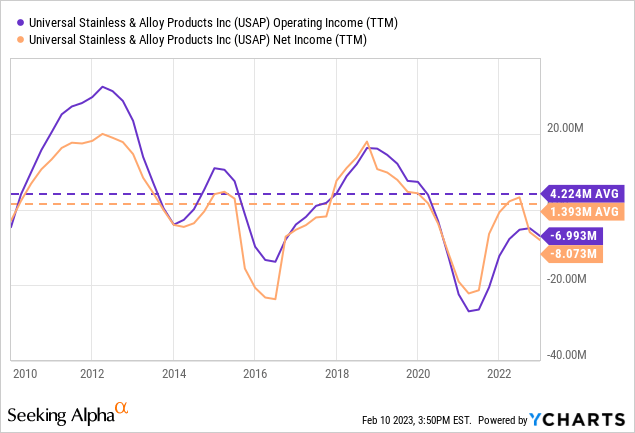

USAP participates in a really cyclical business and isn’t a low-cost producer. For a lot of the cycle, USAP is operationally unprofitable, reaching at some factors destructive gross margins.

At the moment, the corporate is rising revenues, however I imagine it’s a part of one other enterprise cycle and {that a} valuation ought to incorporate cycle averages somewhat than current earnings figures alone.

However even when present profitability was thought of a foundation, and the corporate’s margins have been elevated, the present market cap implies 88% income development sooner or later.

For these causes, I imagine USAP will not be a chance.

Observe: Except in any other case said, all info has been obtained from USAP’s filings with the SEC.

Enterprise description

Metal alloys: USAP manufactures metal alloys, largely stainless-steel (75%). The corporate sells uniform items (ingots, rods, bars) to metal service facilities that then promote them to ultimate customers.

The metal enterprise has many undesirable traits. It requires monumental quantities of mounted capital funding, pushing rivals to cost wars to extend volumes. It’s politically delicate, which results in subsidies to ex-US rivals and boundaries to exit. Aside from particular merchandise, and definitely, not within the case of USAP, metal is a commodity that trades on worth alone. Lastly, metal demand could be very cyclical, however the construction required to fabricate it (or its alloys within the case of USAP) can’t be scaled to suit these demand cycles.

Not the low-cost producer: Some firms can revenue in commoditized and usually undesirable markets like metal by being the low-cost producer. These firms have an enter (uncooked supplies, labor), course of, or one other benefit that enables them to stay worthwhile for a lot of the cycle.

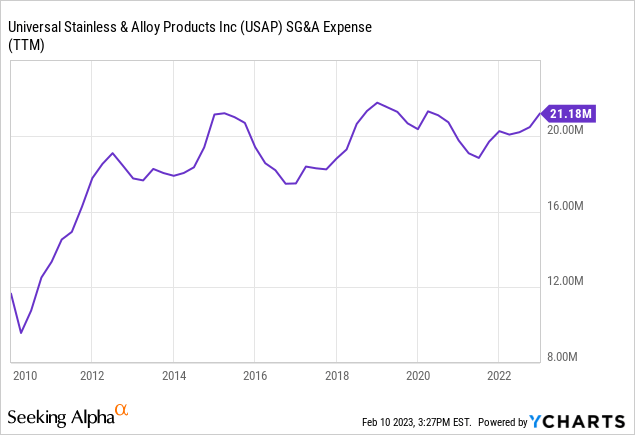

Sadly, USAP appears to be a high-cost producer. This might be very effectively defined by the truth that the corporate is situated within the U.S. North East, the place salaries are excessive in comparison with different areas. Additionally, the corporate’s SG&A bills have been very mounted in comparison with the corporate’s declining revenues.

This has made USAP function beneath the water apart from probably the most distinguished parts of the cycle. So low is USAP’s value benefit that the corporate offered at destructive gross margins through the pandemic.

What’s worse, from the chart beneath, the corporate’s gross margins are lowering for a similar income quantity. Whereas the corporate generated a gross margin of virtually 16% with $200 million in revenues in 2014/5, it solely generated 7% in 2021/22.

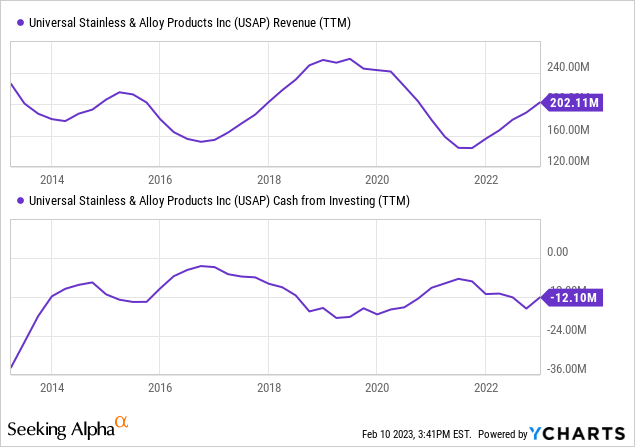

Procyclical capital allocation: One other method an organization in a cyclical business can revenue is to take a position countercyclically. That’s, accumulate money through the higher portion of the cycle to deploy it within the decrease portion, both buying rivals in bother or deploying property that can make it achieve market share within the subsequent upward leg.

Sadly, the chart beneath exhibits that USAP’s investments have been pro-cyclical. The primary chart is income, and the second is money from investing, the place a destructive quantity (decrease within the chart) implies extra investing. Ideally, we’d need each charts to maneuver parallel (greater revenues coupled with decrease funding, that means a price nearer to zero). The chart exhibits the other. The corporate invested extra when costs and demand have been excessive, and fewer when costs and demand have been low.

Not benefiting from the commerce battle: Whereas some historically unprofitable industries benefited from the commerce battle between the U.S. and China, it has not been the case with stainless-steel. That may be seen on the degree of revenues for USAP (most metal tariffs have been carried out in 2018) but in addition on the mixture U.S. degree.

In response to the division of commerce (web page 4), the U.S. imports stainless-steel largely from Taiwan, Italy, India, Japan, and Mexico. China will not be within the prime 5 exporters to the U.S. in any class of metal merchandise. Related conclusions might be drawn from the newest report of the U.S. Census Bureau (web page 8).

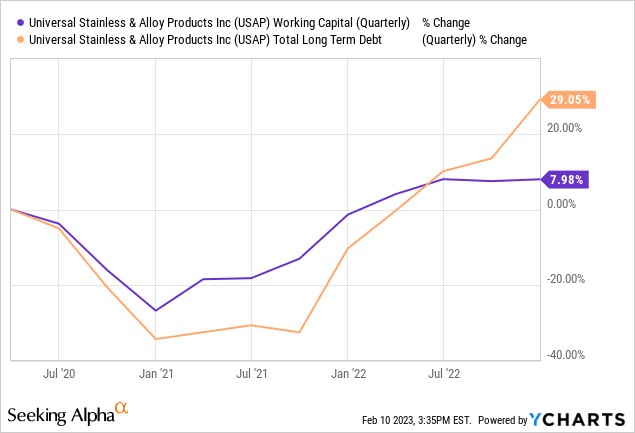

Vital debt is reaching a restrict: As of 4Q22, USAP sustained $100 million in money owed on its revolving credit score facility. The power’s newest modification, from October 2022, authorizes a most of $105 million to be drawn, plus a $15 million time period mortgage. The power pays a 1-month SOFR plus a 2.5% margin (contemplating that greater than 66% of the power has been drawn). This means $7 million in curiosity bills at present charges of 4.5%.

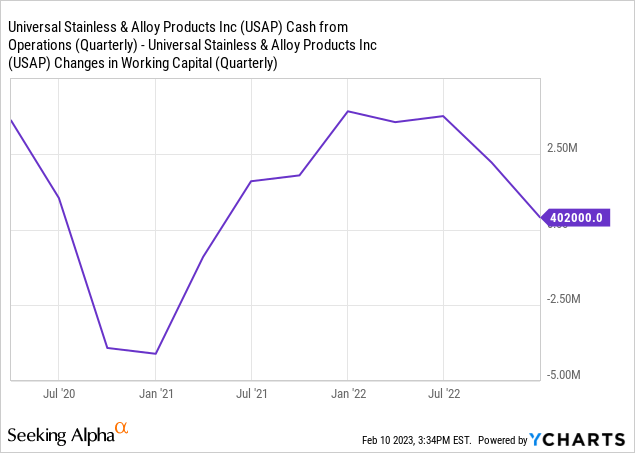

Additional, the corporate has been constructing working capital according to income development, nevertheless it has been unable to finance it out of its working money flows. The chart beneath exhibits CFO earlier than modifications in working capital (if the corporate invests in WC, that means destructive money stream, that’s added again to CFO, and vice versa). The chart exhibits that previously few quarters, USAP has solely been capable of self-finance between $0.5 and $2 million quarterly in working capital.

Valuation

By way of high quality, USAP doesn’t deserve a premium. It operates in a really cyclical business, and its administration has not proven the flexibility to both decrease prices or make investments counter-cyclically.

Additional, the corporate has vital debt, growing through the higher portion of its business’s cycle, which makes it dangerous. In earlier downward parts of the cycle, the corporate was very unprofitable. This additionally provides to dangers.

At the moment, USAP will not be producing internet earnings, so acquiring a a number of on earnings is not possible. USAP will not be even producing working earnings, so even that worth is unavailable.

However we are able to take two approaches to worth the corporate. Each yield that the corporate’s inventory will not be undervalued.

Historic averages: The primary chance, and the right one from a conservative perspective, is to worth the corporate primarily based on a median of its profitability throughout the enterprise cycle. The chart beneath exhibits that, with a present market cap of $85 million, USAP trades at a 60x a number of to common cycle internet earnings and a 20x a number of to common working earnings. Each multiples are very excessive for an organization of USAP’s traits.

Implied development beneath optimistic circumstances: A a lot much less conservative methodology of valuing the inventory is to imagine optimistic circumstances forward and derive what present market costs are asking by way of development. I assume that SG&A is saved mounted at $20 million yearly, that the corporate takes no additional debt, and that it may possibly attain a gross margin of 10%, which was solely reached for a number of quarters in earlier cycle peaks.

Buying and selling at a market cap of $85 million, the investor ought to require not less than $8.5 million in internet earnings. This interprets to roughly $10.6 million in pre-tax earnings, which added to $7 million in curiosity bills and $20 million in SG&A bills, implying gross earnings of $38 million.

Divided by a gross margin of 10%, $38 million in gross earnings turn out to be $380 million. This means 88% income development from present income ranges for FY22. Once more, we assume mounted SG&A, no extra debt, and better gross margins. These are all sturdy and optimistic assumptions.

Even when gross margins have been elevated to fifteen%, one thing virtually unprecedented for the corporate, it could nonetheless must develop revenues to $255 million to succeed in $8.5 million in internet earnings. The corporate solely reached that degree of income twice in its historical past, throughout short-lived cycle peaks.

Conclusions

I feel USAP could be very overvalued, unbiased of the methodology used to method its valuation.

Multiples of common earnings (internet or working) are excessive. These multiples are unjustified for an organization that has proven a declining development in profitability throughout cycles and has not proven fascinating qualitative traits, like good capital allocation or a aggressive benefit.

An optimistic, growth-oriented valuation requires the corporate to develop revenues by 88% (to a degree not achieved even throughout peaks of earlier cycles) to justify its market cap.

For these causes, I favor to keep away from USAP inventory at present costs. I don’t advocate shorting the inventory although, merely to keep away from buying it.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.