wildpixel/iStock by way of Getty Pictures

Monetary Stress Index

Has this market acquired you wired? Apprehensive about mortgages, debt, or the inventory market and whether or not you’ll be able to retire on time?

Sadly I haven’t got a repair for that, however there is a fairly shut second, and it comes within the type of a composite index that may show you how to perceive the day by day state of the inventory market and quantify what “monetary stress” really means for the worldwide monetary system.

The OFR Monetary Stress Index is offered by the Workplace of Monetary Analysis and it’s constructed utilizing 33 monetary market variables. When the FSI index is optimistic it signifies that stress ranges are above common and value being attentive to, and when it’s unfavourable stress ranges are much less worrisome. We go into additional element on that under.

What’s value noting is that these are fairly heavy weight measures, lots of that are utilized by the Fed and funding banks to gauge threat. For these with expertise in monetary markets the FSI consists of:

- Credit score – Credit score spreads, each HR and IG Company

- Fairness valuation – Inventory valuations, the inventory index worth ranges

- Funding – Financial institution lending requirements, credit score circumstances index

- Protected Belongings – Valuations for belongings like Yen, CHF, Gold which can be thought of protected shops

- Volatility – VIX Index, Transfer Index, implied and realised volatility

What we’re going to do on this article is take this current index and back-test it in opposition to the S&P 500 index to show it into a really invaluable and actionable useful resource.

Overview of the Monetary Stress Index and S&P 500

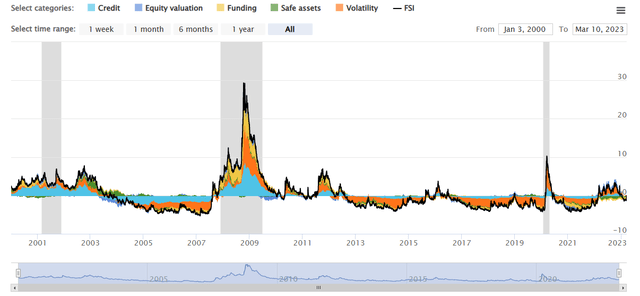

Let’s take a look at the entire dataset from the highest:

OFR Monetary Stress Index web site

The FSI has finished a great job of masking the recessions over the previous 22 years and being aligned to forecasting them with a level of accuracy.

Moreover if we glance intently, in contrast to fairly a couple of indicators, it really accurately responds to the drawn out nature of the Dot Com bust and stays elevated from 2000 till early 2003.

General the index seems to have a great correlation with the inventory market. However how good? We are able to do a deep dive into two main crises after which backtest the mannequin in opposition to the S&P 500.

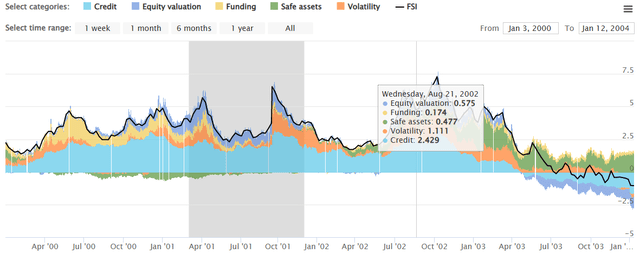

Evaluation of Dot Com Bust (2000-2003)

The Dot Com bust started in late 2000 on the top of the web growth. Many people know the story so we can’t really feel the necessity to enter an excessive amount of element about what began the bust and the components main as much as it.

OFR Monetary Stress Index web site

The FSI registered 2.236 in February of 2000 and this represented elevated credit score spreads, volatility rising and minor funding points within the monetary system. The mannequin remained elevated straight via to the formal onset of recession in 2001, the place it peaked at 5.68 in April 2001 after which troughed however remained above 2.5 into 2002. The mannequin was elevated all through 2002 and peaked even greater at 7.28 in October of 2002. By the top of the Dot Com bust it hit a unfavourable worth in July of 2003.

In the event you had bought in January 2000 – when FSI was above 0, and acquired once more in the beginning of July 2003 – when FSI was under 0, you’d have averted the -31.75% drawdown. This is not the complete drawdown however represents a good proportion of it.

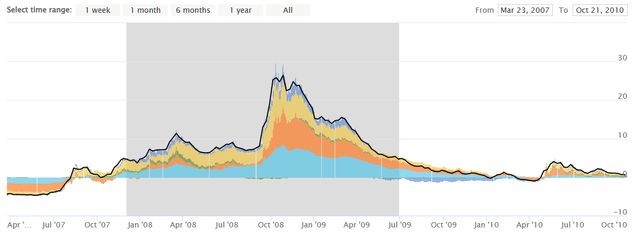

Evaluation of International Monetary Disaster (2008-2009)

It is a related image for the International Monetary Disaster that began in 2007 however actually picked up steam in 2008.

OFR Monetary Stress Index web site

The FSI Index went above 0 in August of 2007 and remained barely above that stage into 2008, the place it steadily rose in the direction of a primary peak in April 2008 at 11.39. The index remained at this elevated stage till it actually took off, when the monetary system was melting down over the winter of 2008 between October and December – hitting an ear splitting all time excessive of 26.42 in October.

The mannequin returned to zero by January 2010. In the event you had bought in August 2007 after which purchased again in when it hit zero in January 2010, you’d have averted -23.24% of the drawdown.

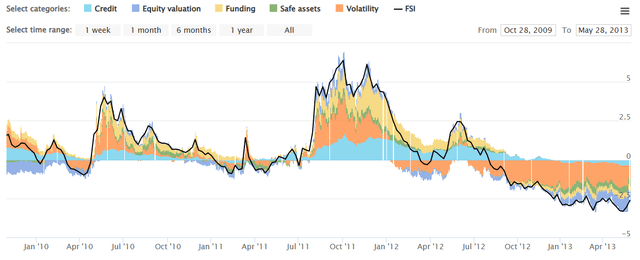

There have been repeat occurences linked to the monetary disaster that appeared in April to December of 2010, and once more in 2011 in the course of the Occupy Wallstreet protests and the European Debt Disaster. Nonetheless slightly than cowl these intimately we’ll refer you to the next chart:

OFR Monetary Stress Index web site

This reveals, once more, the mannequin capturing the strikes pretty nicely on the 0 level.

General Mannequin Accuracy – Adjusting the Mannequin

Clearly for those who can keep away from a serious drawdown in two bear markets then the mannequin will need to have some utility, proper? That after all is dependent upon whether or not the opposite time intervals when it offers false indicators (the mannequin reveals monetary stress however as a substitute of shares happening, they go up) compensate for the worth that you just save throughout real monetary crises.

It is essential after we backtest a system that we do not cherry choose knowledge or assess it merely off of the outputs from a graph. As an alternative we should set truthful parameters and account for buying and selling prices, transactional lag (by at some point) and intervals when the mannequin underperforms.

To be able to pretty assess the mannequin we checked out blanket guidelines throughout the entire knowledge set after which we used Python to backtest the efficiency of the mannequin beneath these circumstances.

Primary System – Guidelines & Circumstances

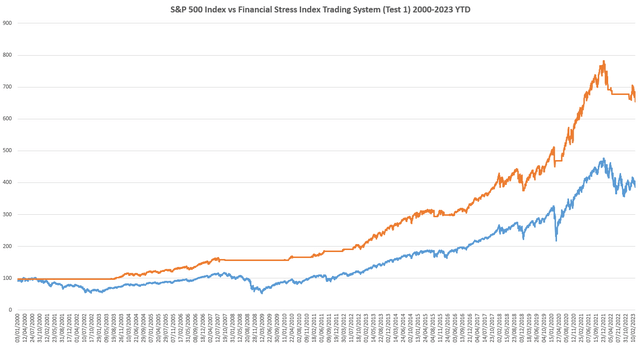

The primary take a look at was for the fundamental system articulated above.

- If the FSI is under 0, the system is a purchase and also you personal the S&P 500 index (SPY)

- If the FSI is above 0, the system is a promote and also you personal money via SPDR Bloomberg 1-3 Month T-Invoice index (BIL)

The outcomes of the primary take a look at are:

David Huston

The vanilla system buying and selling out of the field produces a good return of 671% between the yr 2000 and March 2023 YTD. That is in comparison with a worth return on the S&P 500 index of 396%.

To reveal that there isn’t a monetary chicannery occurring right here we additionally individually seemed on the S&P 500 whole return together with dividends, and having a extra aggressive mounted revenue choice. Our backtesting reveals that for those who use the S&P 500 whole return index and now have your cash invested in TLT or LQD, you get an analogous stage of ourperformance.

However we are able to do higher!

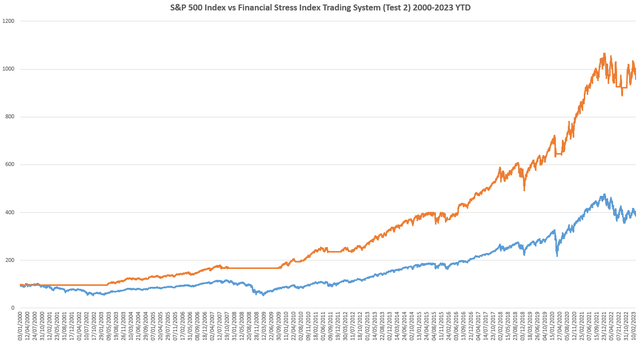

Recursively Optimised System – Guidelines & Circumstances

The second take a look at was for an improved stage of the FCI index. In the event you discover, it triggers barely early throughout each crises. What if we examined all the doable set off ranges and set upon probably the most optimum?

To take action we use a recursive Python mannequin that loops via the information and back-tests it constantly till we discover an optimum determine. Relatively than present all the outcomes we’ll laser in on what got here as an output from this recursive evaluation.

- If the FSI is under X, the system is a purchase and also you personal the S&P 500 index

- If the FSI is above X, the system is a promote and also you personal money via SPDR Bloomberg 1-3 Month T-Invoice index

There’s a important enchancment within the mannequin after it has examined varied choices, together with:

|

Take a look at 5 |

FSI = 0.5 |

S&P 500 = 795% |

|

Take a look at 17 |

FSI = 8 |

S&P 500 = 656% |

|

Take a look at 25 |

FSI = -0.45 |

S&P 500 = 626% |

|

Take a look at 131 |

FSI = 1.3 |

S&P 500 = 873% |

|

Take a look at 204 |

FSI = 1.5 |

S&P 500 = 982% |

The optimum stage for the FSI is definitely 1.5 and this results in a very outstanding outperformance:

David Huston

The system now has a extra granular view of threat, which is calibrated to when the extent of economic stress within the system is sufficient to warrant shifting your cash out of the market and into money or money equivalents.

Additional testing concepts embrace weighting the underlying constituents and getting into the market in sooner than the present mannequin. For instance throughout Covid as soon as the VIX hit an astonishing shut of 65 in March of 2020, when the volatility index subsided one might have taken an earlier lengthy place.

The important thing although is to not make this mannequin too sophisticated and to as a substitute depend on one thing that has a good and constant backtest with out over-fitting the information.

Limitations & Additional Analysis

To cowl off a possible rebuttal to this evaluation. You might be considering: “This solely goes again to 2000 and there have been two main monetary crises throughout that interval. You are cherry choosing the information.”

In a future article I’ll lengthen this evaluation to cowl a precursor to the FSI index, which was referred to as the NFSI index. There are a number of indexes that date again to 1993 (NFSI) and the Nineteen Seventies (ANFCI) they usually additionally present invaluable knowledge for timing the market primarily based on monetary circumstances. Nonetheless, given their variations, I’ve determined to deal with them individually and within the subsequent a part of the sequence in order that our readers can construct on their information and perceive the extra fundamental system first.

One cause we imagine {that a} buying and selling system primarily based across the Monetary Stress Index isn’t commonplace is that macroeconomic timing has fallen out of favour. Have you ever ever heard of Martin Zweig? He was an influential funding adviser recognized for his data-driven research and macroeconomic timing fashions who as soon as owned the costliest penthouse on Fifth Avenue. Through the growth years of the Nineteen Nineties and 2000s his fashions underperformed the market. As with every strategy to producing alpha the efficacy waxes and wanes.

Outcomes

Utilizing the Monetary Stress Index as a information for deciding when to be lengthy the markets seems to be an inexpensive buying and selling technique predicated on the truth that, with elevated monetary stress within the system, there may be additionally elevated chance of a sell-off. We now have used this method final yr as a proxy for threat, which allowed us to regulate our asset allocation accordingly.

For the vanilla mannequin that sells threat belongings when the Monetary Stress Index (FSI) goes above zero, and buys when it’s under 0, the mannequin returns 671% between 2000 and 2023 YTD in opposition to a return of 396% for the S&P 500.

With recursive optimisation utilizing Python we discovered that the mannequin produced a powerful 982% in opposition to 396% for the index, which represents an almost 2.5 fold return in opposition to the index.